Our Cocoa World 2026

Posted by Ruth Medd on 22nd Jan 2026

Quick Jump:

World production, prices and yields. 1

Australia - 2025 Mt Edna Harvest 5

EUDR ( EU Deforestation Reduction) update. 7

This first blog for 2026 covers the Australian and global cocoa scenes.

What does 2026 hold for cocoa, production levels, chocolate trends and Australia?

Late 2025 saw cocoa production stabalising, while demand is growing.

The chocolate media is all over the trend to functional ingredients aka healthy ingredients. One way is to reduce portion sizes with no cost reduction. Another is to add vitamins and various healthy additives to satisfy consumer demand for more healthy options. What is not uppermost is any reduction of the typical 50% sugar component of commercial chocolate. In a high sugar product, sugar will be the first of the ingredients mentioned. Charley’s has 30% sugar.

Ghana and Cote d’Ivoire have long produced 70% of world cocoa. This is changing. West African small holding farmers are likely to continue to struggle for a living wage, despite cocoa price rises during the recent cocoa global price rises. Ghana and Cote d’Ivoire farmers received an increase in the regulated farm gate price but they will need to contend with ill winds in the form of climate change, aging / low yielding trees and inadequate government policies. In production terms, Ghana is likely to be overtaken by Ecuador as the second placed cocoa producer in the period 2026 - 2030. Australia can benefit from the changing global scene. Australia’s first world cocoa industry now has the economic settings to enable profitable expansion.

World production, prices and yields

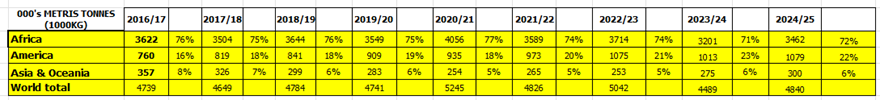

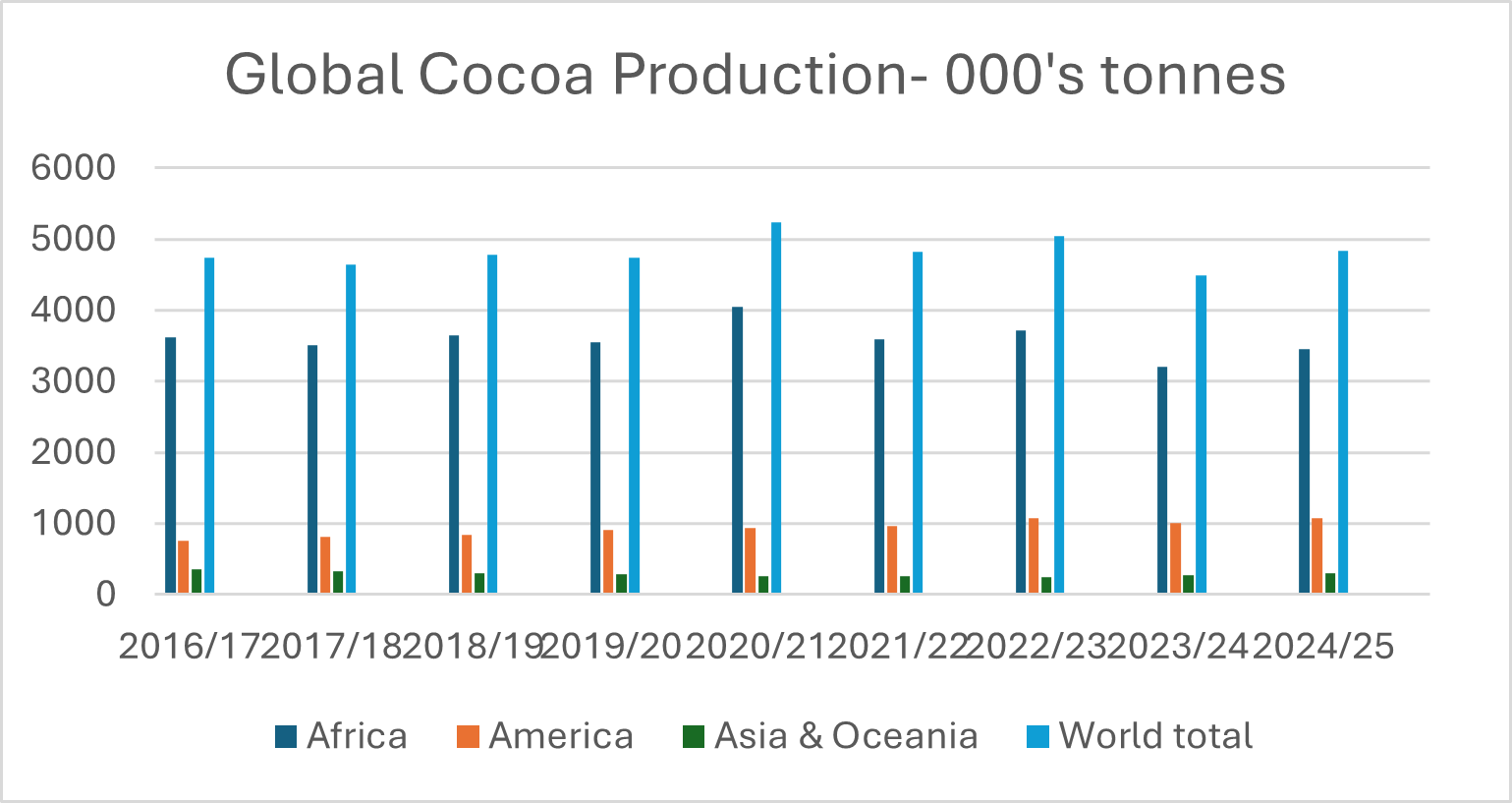

The 2025 season was initially expected to see an increase in cocoa over 2024 from Ghana and Cote d’Ivoire, but both countries downgraded expected production as the year progressed. The most recent ICCO global cocoa forecast (Nov 2025) is 4.698m tonnes from their initial 2025 forecast of 4.840m tonnes.

Historic cocoa production

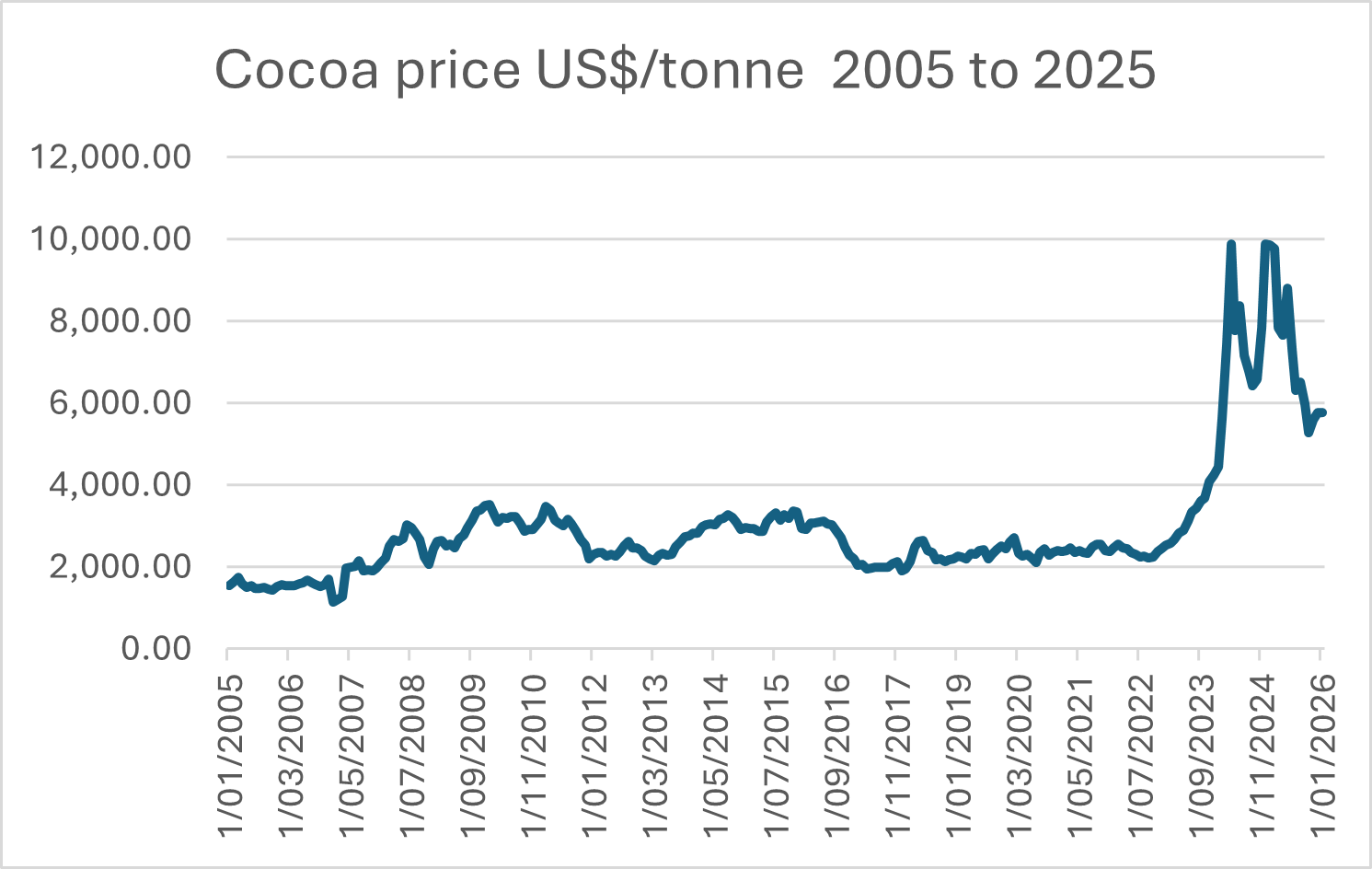

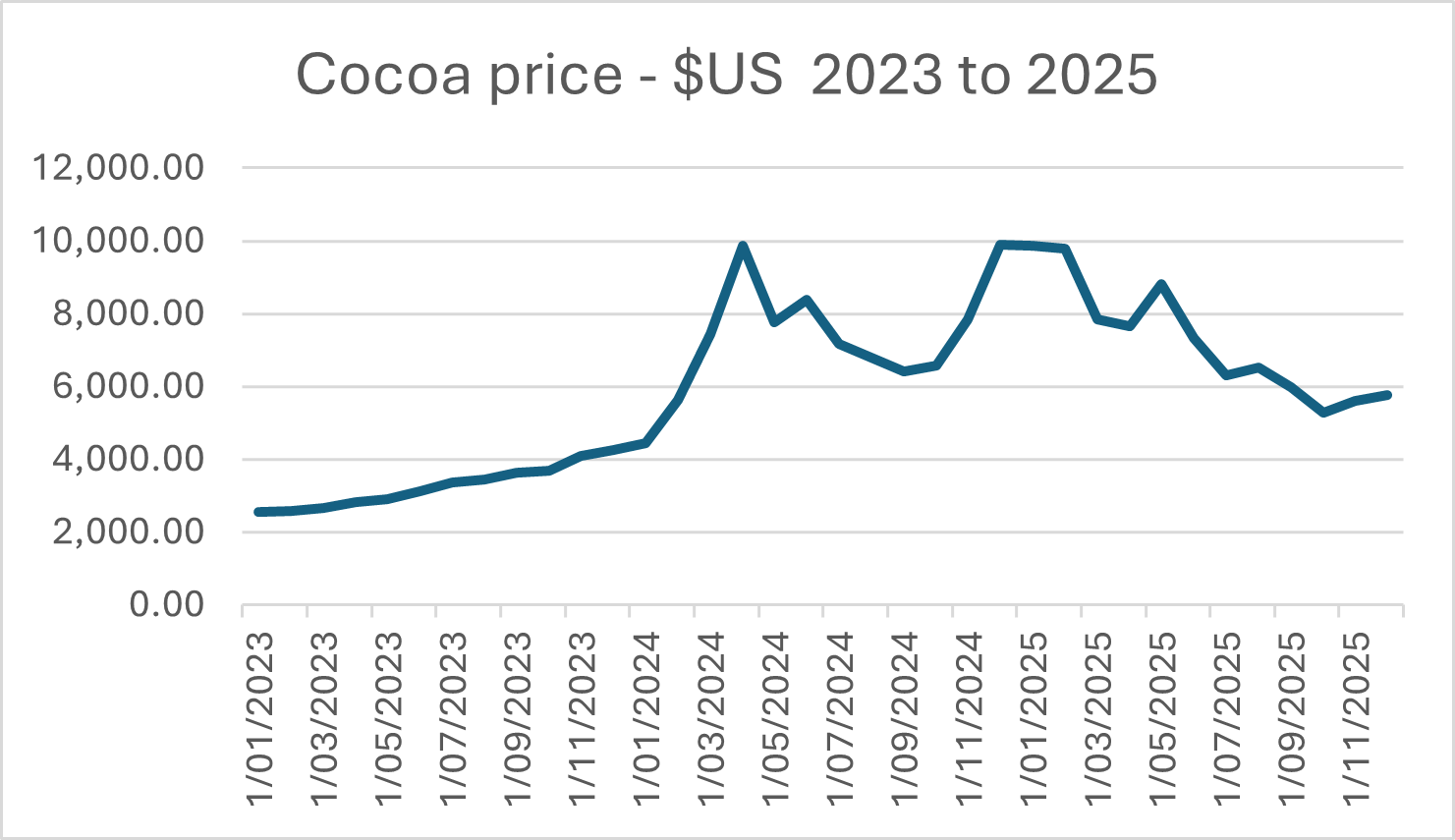

Cocoa prices

Cocoa prices range from a minimum of U$$ 780 on 14/11 2024 to US$12,014 on 18/12 2024. The average price from 1994 to 2025 was US$2102. Reference https://www.icco.org/statistics/

|

|

Date |

US$ |

|

Av price |

1994 - 2023 |

US$ 2,102 |

|

Av price |

2 Jan 2024 – end Dec 2025 |

US$ 9,640 |

|

Highest price |

18 Dec 2024 |

US$ 12,014 |

|

Lowest price |

14 Nov 2000 |

US$ 780 |

After huge rises in 2024 and early 2025, prices have settled toward the long termed expected price of US$6,000 per tonne for commodity cocoa. Australian high quality cocoa should be able to achieve a premium.

Cocoa Yields

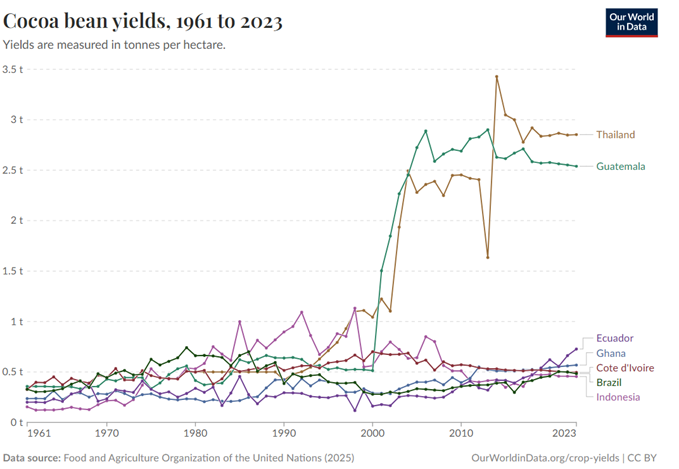

Yields vary from 0.35 tonnes to 3 tonnes. Unfortunately the main producers – Ghana and Cote d’Ivoire are at the 0.5 and below. Honduras and Guatemala planted high yielding cocoa cultivars from 2000, which has significantly increased yields. Australia has access to high yielding cocoa cultivars. Ecuador has some high yielding cultivars that will produce commodity cocoa.

Australia - 2025 Mt Edna Harvest

We are pleased with the 2025 harvest. The additional care and maintenance of the trees plus the progress of Block 4 has resulted in an increased yield of beans at Mt Edna. Block 4 will yield a first year harvest from 2026. We are short of Australian cocoa, so improved yields from Mt Edna and other local growers is very welcome. The 2025 cocoa harvest season is extending into January 2026.

Mt Edna is a seedling orchard based on 5 selected hybrids from the SG2 hybrids varieties created by the Cocoa and Coconut Research Institute (CCRI) of PNG in 1994. As such, some trees are good fruiters, others moderate and some fail.

Block 4 at Mt Edna is planted with high yielding cultivars developed at the Centre for the Wet Tropics Agriculture between 2018 and 2022, which was part of an ACIAR (Australian Centre for International Agricultural Research) project “ Aligning genetic resources, production and post-harvest systems to market opportunities for Pacific Island and Australian cocoa”. Block 4 trees at Mt Edna are expected to produce uniform yields.

Australia – Mt Edna rain

The wet season at Mt Edna and FNQ more widely is an expected annual event, with rainfall varying from year to year. The BOM records rainfall from its rain gauges. Good farmers record their own rainfall. My Edna has been doing this since 2005, which means we have a bank of data that can be used for such things as grant applications.

2025 rainfall in FNQ has been in the news. I did wonder if one of the very capable ABC far north reporters was holidaying in South Mission Beach as that was the focus of some reporting. For those who do not know, South Mission has many palatial holiday dwellings – worth a visit if you are interested in tropical architecture.

Certainly there was a lot of rain. Mt Edna received 986mm in period 28 to 31 December. By way of a simple comparison, the same period in 2024 received zero rain. December 2024 compared with December 2025 was 717mm versus 1442 mm. Overall in 2025 Mt Edna received 5,695mm compared with 5128mm in 2024. Another take on Mt Edna rainfall is the average annual rainfall over the period 2005 to 2025 was 3,661mm, with a low of 2,583 in 2005 and a high of 5,695 in 2025. The highest recorded rainfall in the district was 7,925 mm at Tully, recorded in 1950. Tully is 30km down the road from Mt Edna.

Australia - UQ research

Dr Marlize Bekker of UQ is undertaking research in conjunction with Charley’s. The first project is an analysis of cocoa across 3 locations. Her report will be published shortly.

The research - Cocoa Bean Antioxidant Analysis

Marlize compared cocoa beans from three locations in far north Queensland. This involved various chemical analyses, including measurements of basic chemical properties, total phenolic content, and antioxidant capacity. The results showed statistically significant differences between the samples, with Fishery Falls and Shannonville having similar antioxidant capacities, slightly higher than Mount Edna. She noted that these differences were within expected ranges and could potentially be used for marketing purposes.

The research - Cacao Flavor Analysis

Cocoa flavor analysis of the three cacao samples revealed significant differences in taste profiles and specific compounds like theobromine and organic acids. Shannonvale had the highest concentration of theobromine, while Fishery Falls and Mount Edna had more lactic acid and acetic acid, respectively. The analysis of volatile compounds showed 90 different compounds, with fermentation playing a key role in flavor development.

Suggested further research includes looking at the unique microbiome of rainforest fermentation in FNQ. If you would like to support this research, get in touch with Charley’s.

EUDR ( EU Deforestation Reduction) update

EUDR aims to reduce deforestation by limiting access to the EU for a range of agricultural products (including cocoa) if they are unable to demonstrate the crop is grown on land free of recent deforestation.

On 26 November 2025, the European Parliament voted on a range of proposals to further amend the EUDR. The amendments still need to be agreed by the European Council and Commission to be adopted. In summary, the European Parliament voted in favour to:

- Postpone the application of the EUDR by a further year to 30 December 2026 for medium/large EU businesses and for 18 months to 30 June 2027 for small/micro EU businesses.

- Require a review of the EUDR by 30 April 2026 on ways to further simplify the EUDR. The review intends to assess the administrative burden of the EUDR and could be followed by further legislative proposals.

- Remove printed books, newspapers, pictures and other products of the printing industry from the scope of regulated products.

- Provide some simplifications of the due diligence requirements for EU operators, particularly small/micro businesses and ‘downstream’ operators.

Implementation

Since the majority of global cocoa is grown by millions of smallholder farmers who lack the necessary technology or funding, major international efforts are focused on building capacity in countries like Ecuador and those in West Africa.

Programs like the GIZ/Preferred by Nature SAFE Programme in Ecuador are training thousands of small farmers and their cooperative managers on how to:

- Use GPS tools to map their own farm boundaries (polygons).

- Understand the EUDR requirements.

- Implement basic Due Diligence Systems (DDS) at the cooperative level.

Cocoa-producing government agencies (e.g., Ghana's COCOBOD) are developing national, centralised traceability systems that map all registered farms and link them to deforestation risk modules. Data from HS Code 180100 shows that 71% of Côte d'Ivoire and Ghana 58% of Ghana cocoa is exported to the EU.

References

Aug 2025 - https://www.charleys.com.au/blog/australian-cocoa-versus-the-world/

Jan 2025 - https://www.charleys.com.au/blog/january-2025-our-australian-cocoa-world-/

Oct 2024 - https://www.charleys.com.au/blog/could-you-be-a-cocoa-farmer/

Mar 2024 - https://www.charleys.com.au/blog/international-cocoa-activites/

Nov 2025 – ICCO 2024/25 revised estimates

- https://www.icco.org/november-2025-quarterly-bulletin-of-cocoa-statistics/

- https://www.icco.org/?s=2025+global+production